Under Illinois wage laws, overtime pay exemptions are subject to specific regulations that determine whether employees are eligible for additional compensation beyond the standard workweek. In Illinois, most workers are entitled to overtime pay for hours worked over 40 in a week. However, there are notable exemptions based on job duties and salary levels. Understanding these exemptions helps employees ensure they are correctly classified and receive fair compensation for their time.

Understanding Overtime in Illinois

In Illinois, overtime is governed by both federal and state regulations, ensuring that employees receive fair compensation for extensive work hours. Overtime typically means any hours worked beyond the standard 40-hour workweek. According to these laws, qualifying employees should receive one and a half times their regular pay rate for each hour worked over 40. However, not all employees are covered by these regulations. Certain positions, based on duties and salary, may be exempt from overtime. Workers must understand whether they fall under these exemptions to protect their rights to appropriate compensation. Additionally, Illinois laws offer specific provisions that differ slightly from federal guidelines, affecting how overtime is calculated and applied.

Who Is Exempt from Overtime Pay?

In Illinois, while many employees are entitled to overtime pay, significant exemptions affect a variety of workers. Understanding who is exempt is necessary for both employers and employees to ensure compliance with wage laws and guarantee fair compensation.

- Executive Employees: These are individuals who primarily manage the business or a recognized department. They must regularly direct the work of at least two other full-time employees and have the authority to hire or fire. Their decisions should carry significant weight in the overall operations. They must also be paid on a salary basis with earnings that exceed the minimum established threshold.

- Administrative Employees: Employees under this category perform office work directly related to management or general business operations. They must exercise discretion and independent judgment in significant matters. This group typically includes roles like HR managers, financial officers, and other senior administrative roles. They must also be paid on a salary basis with earnings that exceed the minimum established threshold.

- Professional Employees: This exemption covers employees engaged in work requiring advanced knowledge in fields of science or learning, typically acquired through prolonged education. This includes roles such as lawyers, doctors, engineers, and teachers, who apply discretion and judgment in their work. It also includes creative professionals who perform work requiring invention, imagination, or talent in an artistic field.

- Computer-Related Jobs: Employees in this category must be engaged in computer systems analysis, programming, software engineering, or other similarly skilled computer-related roles. They should primarily work on application design, system analysis, or other functional areas requiring highly specialized knowledge. Importantly, not all IT roles qualify; the work must be highly specialized and intellectual in nature. They must also be paid on a salary basis with earnings that exceed the minimum established threshold or on an hourly basis with a rate of at least $27.63 per hour.

- Outside Sales Employees: This exemption applies to employees whose primary duty is making sales or obtaining orders or contracts for services where the payment is through commissions. These workers must be mainly engaged away from the employer’s place of business, conducting sales in the field. The nature of their work requires them to be out of the office, directly interacting with clients or potential customers.

For the job categories requiring that an employee be paid on a salary basis and meet a minimum salary requirement to be exempt, currently, they must be guaranteed a salary of at least $684 a week.

Other Exemptions and Special Cases

Beyond the commonly recognized categories, Illinois wage laws include other exemptions and special cases regarding overtime pay. Some of these exceptions include the following:

- Seasonal Workers: Individuals employed in recreational or seasonal establishments, such as summer camps or seasonal amusement parks, may not qualify for overtime pay under the Federal Labor Standards Act (FLSA) if the establishment operates only for a limited time each year.

- Agricultural Workers: Employees engaged in agriculture, including farming, cultivation, and livestock management, typically fall outside the standard overtime pay requirements due to the seasonal nature and varying intensity of agricultural work.

- Domestic Workers: Although often eligible for overtime, live-in domestic workers, such as housekeepers, nannies, and caregivers, may have different considerations based on their work arrangements and contracts.

These specific exemptions highlight the complexity of federal and Illinois wage laws and underscore the need for workers to be aware of their rights and the particular conditions of their employment.

Misclassification of Construction Workers

The Illinois Employee Classification Act (ECA), effective since January 2008, targets unfair pay practices in the construction industry by addressing the misclassification of workers as independent contractors rather than employees. Under the ECA, construction workers in Illinois who have been misclassified can file a lawsuit to recover lost wages, employment benefits, and other compensation. Additionally, they may be entitled to liquidated damages, doubling the total amount recoverable. Claims must be filed within three years from the final service date provided to the construction contractor, ensuring workers’ rights to equitable compensation are protected.

Expense Reimbursement and Enforcement of Wage Laws

Effective January 1, 2019, Illinois law mandates that employers reimburse employees for necessary expenses—defined as reasonable expenditures or losses required of the employee in the performance of their job duties that principally benefit the employer. Employees must submit these expenses for reimbursement within 30 days unless the employer’s written policy specifies a longer period. Failure to adhere to the employer’s written expense reimbursement policy may result in a denial of reimbursement.

When there is an allegation of wage violation, the Illinois Wage Payment Act allows employees, individually or as a class action, to sue without prior claims filed with the Illinois Department of Labor (IDOL). Lawsuits can be initiated in the county where the violation occurred or where any affected employee resides. Employers who delay or fail to properly pay wages may incur a penalty of 2% of the unpaid wages per month of underpayment, in addition to facing potential costs and attorneys’ fees. Additionally, sales representatives not receiving timely commissions may seek up to three times the owed amount in punitive damages.

How to Determine If You’re Exempt

Determining if you are exempt from receiving overtime pay under Illinois wage laws requires a detailed examination of both your job duties and salary. Initially, closely examine your official job description and the tasks you perform regularly. It’s essential to align these with the established criteria for exempt statuses. Remember that your exemption status depends on your actual job functions rather than just your job title.

Next, assess your salary to ensure it meets or surpasses the minimum required for exempt employees, keeping in mind that these thresholds can change. Your salary should also be on a “salary basis,” guaranteeing a set minimum regardless of hours worked. Note that being paid on a “day rate” basis does not qualify as a salary, no matter how much an employee earns.

What to Do If You’re Wrongly Classified

If you think you’ve been incorrectly classified as exempt from overtime pay, begin by gathering all pertinent employment documents, such as your job description, employment contract, pay stubs, and any records of your working hours. These items will form the foundation of your case by illustrating your actual duties and the compensation you received. If there’s a discrepancy, address it with your employer or the human resources department, as the issue could be an unintentional oversight. However, if this does not resolve the issue, or you seek more formal guidance, consider consulting an employment law attorney who handles overtime pay cases. They can evaluate your situation, clarify your rights, and recommend a course of action, including possibly filing a claim with the Illinois Department of Labor or a class/collective action to recover any unpaid overtime.

Contact the Lore Law Firm About Overtime Exemptions in Illinois

The Lore Law Firm is dedicated to protecting your employment rights, including fair overtime compensation. Our experienced team can evaluate your situation, guide you through your options, and represent your interests. If you suspect your overtime pay rights have been violated, complete our free and confidential online client intake form and get the back wages you deserve.

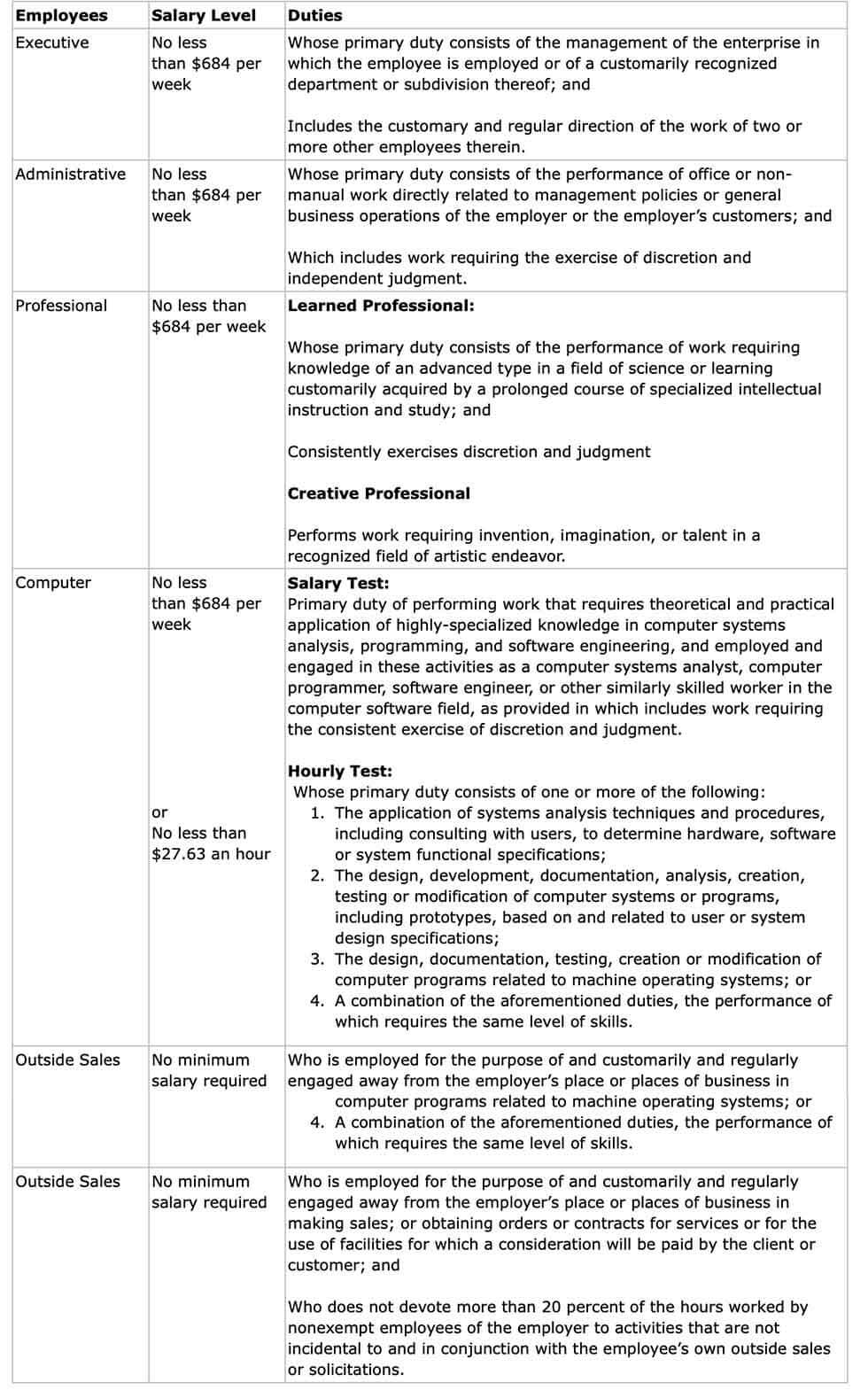

The following chart summarizes the various exemptions from overtime pay that are recognized by Illinois labor law and includes information about the required minimum salary and the job duties necessary to qualify for the exemption. In order to be exempt, an employee must meet both the salary and job duties requirements. The Executive, Administrative and Professional exemptions are commonly referred to as the “white collar” exemptions from overtime pay.